Indonesia: Too Big to Ignore in the Global Critical-Minerals Equation 🇮🇩🇺🇸

- Wesley Campbell

- Dec 8, 2025

- 2 min read

Indonesia is known as a top producer of nickel, placing it at the center of global supply for stainless steel, EV batteries, and clean-energy infrastructure. A recent analysis from the National Bureau of Asian Research (NBR) concludes that Indonesia is “too important and too large a producer to be left out” of U.S. critical-minerals strategy. As the United States works to secure reliable supply outside of China, Indonesia’s role becomes increasingly difficult to ignore.

This is where Nusa Nickel provided an intriguing opportunity for the Western world. With the push for MHP and class 1 nickel resources, Nusa remains North America's only revenue generating producer and licensed nickel trader in the country. While continuing to solidify relationships with non-FEOC processors, Nusa Nickel aims to be a part of the only completely non-FEOC nickel supply chain operating within the Indonesian Nickel Industry. This key detail sets Nusa Nickel apart from many as we have direct access to low-cost and abundant nickel resources that the US and western nations cannot ignore.

Source: NBR, National Bureau of Asian Research

Indonesia’s Rise From Ore Exporter to Nickel Powerhouse

Indonesia’s transformation has been driven by deliberate policy. The government’s push to ban raw ore exports and require domestic processing has led to the build-out of smelters, HPAL plants, and integrated industrial parks. As a result, nickel has now overtaken coal as Indonesia’s top export, reaching US$16.5 billion in the first half of 2025, according to Macquarie.

Source: MINING.com reporting on Macquarie data

Why This Matters to the United States

The United States relies heavily on imported nickel, historically from Canada, Norway, and Australia. As battery adoption expands, U.S. policymakers face a structural challenge: the majority of global nickel growth sits in Indonesia. NBR’s report notes that bringing Indonesia into U.S. supply-chain planning will be essential for long-term energy security and industrial policy.

Source: NBR, National Bureau of Asian Research

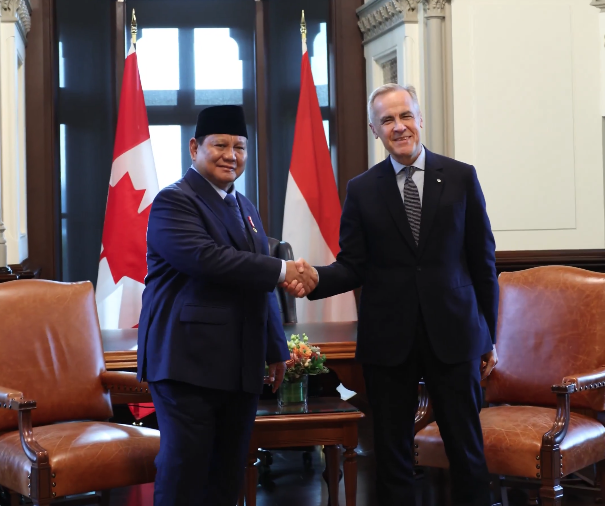

Recent U.S.–Indonesia discussions on “strategic trade management” reflect this shift. Washington is exploring ways to structure transparent verifiable flows of critical minerals, including nickel, in partnership with Jakarta.

Source: Reuters coverage of U.S.–Indonesia talks

Nusa Nickel’s Position in This Strategic Landscape

1. A bridge for North-American capital

Nusa Nickel offers a unique structure: Canadian governance combined with Indonesian operations, giving North-American investors transparent, pure-play access to the world’s top nickel district.

2. Trader-licence advantage

With our Indonesian trader licence active, we can supply our own nickel material and aggregate third-party tonnage. This, in future, would provide a compliant non-FEOC channel aligned with the transparency the U.S. seeks in critical-minerals trade frameworks.

3. Aligned with supply-chain diversification

As global buyers look for nickel supply chains that avoid over-concentration in any single jurisdiction, Indonesia is becoming a necessary partner. Nusa Nickel’s position within Sulawesi’s smelter corridor places us directly in that flow.

4. Scalable growth inside Indonesia’s industrial ecosystem

With modular expansion pathways, Nusa Nickel is positioned to scale responsibly as demand from stainless steel, battery intermediates, and Western supply chains increases.

Indonesia’s dominance in nickel is not cyclical, it is structural. For the United States and its western allies, engaging Indonesia is becoming a strategic requirement. For Nusa Nickel, it is an opportunity to demonstrate how a compliant, transparent, North-American-led operator can contribute to the future of global nickel supply.

Comments